The Emerald

Market

A Transformative Period

Emeralds: A Rising Demand and Promising Investment Future

The global emerald market is currently undergoing a notable transformation propelled by shifting consumer preferences and evolving market dynamics.

Here’s an overview of the key factors driving the current demand and future trends shaping the emerald market:

Market Growth and Forecast

The global coloured gemstones market, including emeralds, is projected to grow at a robust rate of 4.8% annually from 2021 to 2026. This growth is driven by increasing consumer demand for unique, high-value gemstones and the expanding influence of online retail channels. In particular, the segment for ethically produced emeralds is anticipated to match or even exceed this growth forecast, reflecting the shifting preferences towards sustainable and socially responsible practices.

Supply Constraints: Driving Price Appreciation

Unlike commodities with flexible supply chains, emeralds are inherently limited in quantity. Mainly mined in countries such as Colombia, Brazil, and Zambia, each region produces emeralds with unique characteristics and varying qualities. Covid, recent geopolitical tensions and stringent environmental regulations have further constricted supply chains, intensifying scarcity and consequentially driving prices upwards. This imbalance between supply and demand enhances the investment potential of emeralds, reinforcing their long-term viability as secure and profitable investment assets.

Emerald Buyers Have Moved Online & Are More Geographically Diverse:

“At the Christie’s online jewellery auction at the end of June (2020), an emerald-cut 28.86ct D-colour type-IIA diamond (chemically pure, with limpid beauty) went for $2.1m. During the sale, Christie’s reported unprecedented digital engagement across 134 countries, with a 70 per cent increase in daily visitors to the sale page compared with its online jewels sale in June last year”

Source: Financial Times article “Gem Up – why luxury clients are reaching for fine jewellery” – Vivienne Becker October 5, 2020

The Growing Demand for Safe-haven Investments.

Diamonds Lose Their Shine: The Rise of Coloured Stones

Advancements in synthetic diamond production have blurred the line between natural and lab-grown diamonds, impacting prices and consumer appeal. As a result, discerning buyers are increasingly turning to natural colored gemstones like emeralds for their authenticity and exclusivity. This shift has led to a decline in diamond dominance in jewelry, with colored gemstones gaining popularity. Consumers now prefer these unique stones to express individuality and style, favoring them over potentially mass-produced alternatives or indistinguishable natural diamonds. Those who previously chose diamonds as status symbols are moving away from them due to the difficulty in distinguishing them from synthetic ones and are looking for the next gemstone to be an undeniable symbol of wealth and luxury.

Other positive factors

The Big Three: Emeralds, Sapphires & Rubies

Emeralds, sapphires, and rubies constitute the esteemed 'big three' of precious gemstones. Revered across diverse cultures since ancient times, these gems hold enduring popularity that ensures consistent demand for emeralds well into the future.

Global Economic Expansion and Cultural Affinity

Emerging markets across India, Asia, and Latin America have seen substantial economic growth, fostering a new wave of affluent consumers with a deep cultural and historical appreciation for emeralds. The rise in disposable incomes among these demographics continues to drive and secure demand for emeralds in the global market.

Aligning purchasing decisions with ethical values.

Younger consumers are increasingly becoming key players in the emerald market. Unlike traditional buyers, these new entrants place a strong emphasis on ethical mining and sourcing practices. They are keenly aware of the unregulated and nontransparent nature of much of the emerald supply chain and actively seek out ethically produced gemstones.

Gemfields: A Key Bellwether for Understanding Emerald Market Trends

Gemfields, a leading producer of colored gemstones, holds a significant stake in the global emerald market, contributing 25% of the world's production. Operating the Kagem emerald mine in Zambia, the largest of its kind globally, Gemfields is publicly listed on the Johannesburg Stock Exchange . The company sell via auction, and offers two grades of emeralds: premium quality for discerning buyers and commercial grades for broader market appeal.

Gemfields' auctions of these emeralds are highly anticipated events in the industry, providing critical insights into market dynamics. Their reports on production, sales performance, and market trends offer valuable data on supply, demand, pricing, and consumer preferences globally. This information is indispensable for investors, collectors, and industry stakeholders seeking to assess market health and direction.

Key Gemfields Emerald Rough Sales Highlights

- Revenue Growth:

- March 2023 auction of commercial-grade rough emeralds achieved USD 21.2 million, averaging USD 7.13 per carat.

- May 2024 auction of higher-quality emeralds generated USD 35.0 million, averaging USD 167.51 per carat (Gemfields Group).

- Record-Breaking Sales:

- June 2023 set a record with USD 43.7 million from an auction of higher-quality emeralds, marking the highest revenue for any Kagem emerald auction to date.

- Consistent Demand:

- Throughout 2023 and 2024, auctions consistently sold high percentages of offered lots. For example, the September 2023 auction sold all 43 lots, achieving USD 25.5 million in revenue at an average of USD 7.51 per carat.

As of mid 2024, Gemfields have held 47 Kagem Emerald Auctions. Beginning in July 2009, rough emerald sales from the mine have generated over a billion ($1,006 million) in total revenue .

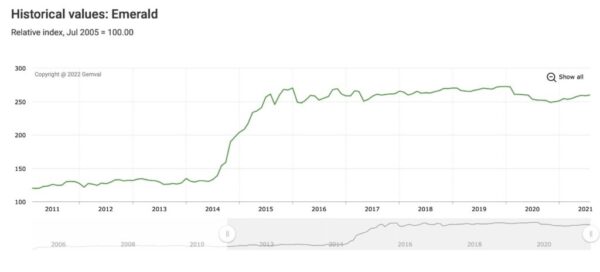

Emerald Market Insights: The Pandemic's Impact

As of mid-2024, Gemfields has conducted 47 auctions of Kagem emeralds, generating over $1 billion in total revenue since July 2009 from rough emerald sales. However, it was during the pandemic that the market witnessed significant growth, characterized by a notable surge in emerald prices.

Amid the pandemic, Gemfields reported that emerald prices per carat more than doubled for high-quality stones over a 12-month period.

For investors eager to understand the emerald market, analyzing Gemfields' auction data offers compelling insights for informed decision-making.

Explore how the pandemic reshaped emerald prices and gain valuable insights into future trends by delving into our detailed analysis of Gemfields' auction data [HERE].